California Minimum Auto Insurance Requirements

When an accident occurs in California, whether an automobile accident or an accident such as a slip and fall on someone else’s property, the way that injuries are almost... Read More

Should Bay Area carpool lanes be enforced 24/7?

Carpool lanes are an essential part of the Bay Area’s transportation infrastructure, designed to encourage carpooling, reduce traffic congestion, and improve air quality. As the population continues to grow... Read More

Here Are The Top Causes of Distracted Driving

These 15 Driving Distractions Could Ruin Your Day. Wouldn’t it be nice to settle in to your morning commute in total relaxation, catching up with a friend in the... Read More

Here are the Scariest Roads in California

What comes to mind when you think of traffic laws? There are right-of-way rules that say who yields and who proceeds at traffic intersections and crosswalks. And speed limits.... Read More

The complicated story behind widening Highway 1 in Santa Cruz

Santa Cruz County is in the midst of a debate over how to relieve gridlock along Highway 1. Traffic congestion has continued to worsen in recent years along the... Read More

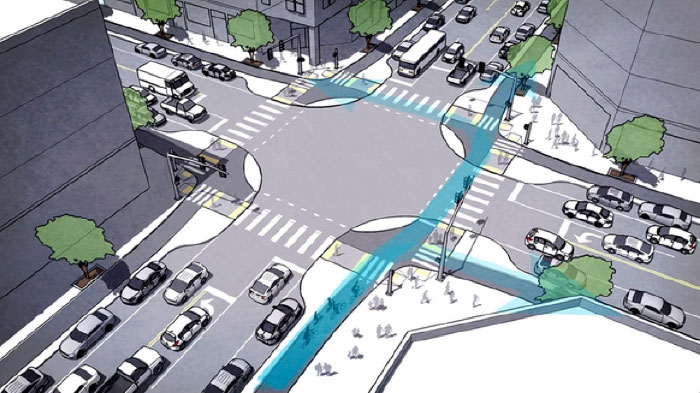

What is a protected intersection?

As protected bike lanes become more common across the U.S., the way in which we design intersections is also evolving. American cities are on the cusp of implementing the... Read More