Unfortunately, most insurance companies do not provide coverage for life flight insurance or air ambulance service, leaving individuals and their loved ones burdened with the cost of emergency airlifting after an accident. If you or someone you know had to be airlifted after an accident you should contact a personal injury lawyer right away.

Insurance companies are business first and typically will avoid paying any bills they don’t have to which can put a tremendous financial burden on injury victims including bills from the life flight network.

Understanding Your Health Insurance and Life Flight Coverage

When facing a medical emergency requiring helicopter transport or medical airlift, understanding your insurance coverage becomes critical. The relationship between health insurance and life flight services is complex, and many patients discover too late that their coverage is limited or non-existent.

Does Private Health Insurance Cover Air Ambulances?

Private health insurance coverage for emergency medical transport varies significantly between policies and providers. While most private insurance plans include some form of emergency transportation benefits, the extent of coverage for air ambulance services often falls short of actual costs.

Many private insurers categorize medical helicopter rides as “out-of-network” services, meaning they’ll only cover a fraction of the bill – typically what they deem “reasonable and customary.” This determination often leaves patients responsible for thousands of dollars in balance billing. For example, if your insurer determines $5,000 is reasonable for a care flight that costs $20,000, you’re responsible for the remaining $15,000, even with insurance.

Key factors that affect private insurance coverage include:

- Whether the air ambulance provider is in-network

- The specific terms of your deductible and out-of-pocket maximum

- Whether the transport was deemed “medically necessary”

- Your plan’s annual or lifetime limits on emergency transportation

Medicare and Medicaid Coverage for Life Flights

Does Medicare cover life flight? Medicare Part B covers emergency ambulance services, including medical helicopter transport, when ground transportation would endanger your health or when you need rapid transport to a facility that can provide necessary care. However, Medicare typically only covers 80% of the approved amount after you’ve met your deductible, leaving you responsible for the remaining 20% plus any charges above Medicare’s approved rate.

Does Medicaid cover life flight? Medicaid coverage for medflight services varies by state but generally covers medically necessary emergency air transport. Unlike Medicare, Medicaid typically provides more comprehensive coverage with minimal out-of-pocket costs for eligible beneficiaries. However, prior authorization requirements and network restrictions can still create coverage gaps.

Air Ambulance May Not Be Included In Your Insurance Policy

According to the Association of Air Medical Services, more than 550,000 people receive airlift services every year in the U.S.

While some are pre-planned and coordinated to transport patients between medical facilities, the majority of airlift situations are due to accidents and emergencies.

Insurance coverage for life flights may be deemed medically necessary based on the availability of specialized care in a particular medical facility.

Many people who have coverage through their employer, a self-insurance plan, Medicare, or Medicaid may assume that these services are included in their policy.

It comes as a shock when they receive a bill and must pay out-of-pocket because their claim for an airlift is denied by an insurance representative.

However, there may be many factors that determine your entitlement, or lack of it, so don’t accept a denial at face value.

Here are some reasons why you should contact a knowledgeable insurance disputes lawyer when your medical insurance won’t cover the cost of your airlift.

Breaking Down the Cost: What to Expect from a Life Flight Bill

Understanding the components of your life flight bill can help you identify potential areas for dispute and better navigate insurance claims. The average cost of life flight services includes multiple factors that contribute to these substantial charges.

How Much Does a Life Flight Cost Without Insurance?

Without insurance, patients face the full burden of air ambulance costs, which typically range from $12,000 to $25,000 for a standard transport. However, costs can escalate dramatically based on several factors:

Distance-Based Charges:

- Base rate: $8,000-$12,000 for helicopter deployment

- Per-mile charges: $100-$300 per mile flown

- Long-distance transports exceeding 100 miles can push costs above $40,000

Medical Care Components:

- Specialized medical crew: $2,000-$5,000

- Advanced life support equipment: $1,500-$3,000

- Medications and medical supplies: $500-$2,000

- Critical care monitoring: $1,000-$2,500

Additional Factors Affecting Airlift Cost:

- Night flights (10-20% surcharge)

- Weather-related complications

- Landing zone preparation

- Ground ambulance coordination

- Return flight for crew

Understanding these costs becomes crucial when determining how much does it cost to be life flighted and whether you have grounds for a personal injury claim to recover these expenses.

What is the Average Cost of Air Medical Transport?

The average cost of a life flight in the US is between $12,000 and $25,000. The air ambulance cost can vary significantly based on factors such as distance traveled, type of aircraft used, and specialized medical equipment required.

Did a loved one require a flight for life?

See if you might have a personal injury case. Insurance coverage for life flights often depends on whether the service is deemed medically necessary in the event of a serious medical emergency. It’s completely free, with no obligations.

At GJEL, we can help you maximize the value of your case, ensure you receive the proper medical attention, and hold wrongdoers accountable.

Life Flight Membership Programs: Are They Worth It?

With the uncertainty surrounding insurance coverage for helicopter transport, many families consider life flight insurance through membership programs. These programs, offered by companies like AirMedCare Network, REACH Air Medical Services, and Guardian Flight, promise to cover out-of-pocket costs not paid by insurance.

Understanding Life Flight Membership Benefits

Annual membership fees typically range from $65 to $150 per household and can provide:

- Coverage for any medically necessary flight by participating providers

- No out-of-pocket expenses beyond what insurance pays

- Coverage for all household members

- Reciprocal agreements with partner networks nationwide

Important Limitations to Consider

Before purchasing flight for life insurance through membership programs, understand these critical limitations:

- Network restrictions: Only covers flights by participating providers

- Geographic limitations: May not cover flights outside service areas

- Non-emergency exclusions: Doesn’t cover scheduled medical transfers

- Insurance coordination: Requires you to use your primary insurance first

For California residents, it’s essential to verify which care flight providers participate in your chosen membership program, as coverage gaps could still leave you with substantial bills from non-participating emergency medical transport services.

Insurance Companies are Businesses First

You may pay your premiums regularly, and thus expect proper customer service from your insurance company. Still, an insurance company is a business first and foremost.

These companies are motivated to maximize profits and minimize losses, and your claim for the cost of an airlift may be viewed by your insurer as another potential disputed item. They may deny your claim for airlift because they do not expect much of a fight if you do not have a lawyer, leaving you with significant out-of-pocket costs even with health insurance.

Insurance Representatives Do Not Work for You

The National Association of Insurance Commissioners reports that the average cost for one air ambulance flight is between $12,000 and $25,000. Insurance companies often examine the circumstances of the airlift to determine if they will cover air ambulance services. Insurance companies often do all they can to avoid payment of a claim for this high amount, so they frequently put their best claims employees on these matters.

Even though they are not attorneys, insurance company representatives have experience and in-depth knowledge of the law. They may seek loopholes, assert that the transportation was not medically necessary, or find other reasons to find that an airlift is not covered. You are at a disadvantage unless you have a lawyer to fight for your rights.

How much does a life flight cost without insurance?

The cost of a Life Flight with insurance can vary depending on a number of factors such as the type of insurance coverage you have and the specific terms of your policy.

The high costs associated with air medical transport can be a significant financial burden without insurance coverage. Generally, Life Flight services can be quite expensive, ranging from several thousand dollars up to tens of thousands of dollars.

However, if you have insurance that covers Life Flight services, your out-of-pocket costs may be significantly reduced. Many insurance plans cover at least a portion of the cost of Life Flight services, and some plans may cover the entire cost.

To find out exactly how much you would pay for a Life Flight with insurance, it’s best to consult with your insurance provider. They can provide you with detailed information about your coverage and any out-of-pocket costs you may incur. It’s important to remember that if you are in an emergency situation and require Life Flight services, your health and safety should always be your top priority, regardless of the cost.

How much is life flight without insurance depends on your individual carrier.

How much does a life flight cost with insurance?

Unless you have specific coverage for life flights you may be responsible for life flight fees. The high costs associated with air medical transport services make it essential to have specific coverage for these services. There are also separate life time policies you can get that will cover air ambulance flights if purchased before the need arises.

Fighting Denied Claims and Disputed Medical Bills

When facing a denied claim for air ambulance services, you’re not powerless. Insurance companies often deny legitimate claims hoping policyholders won’t fight back. Understanding your rights and the appeals process can make the difference between paying tens of thousands out-of-pocket or having your medical helicopter costs covered.

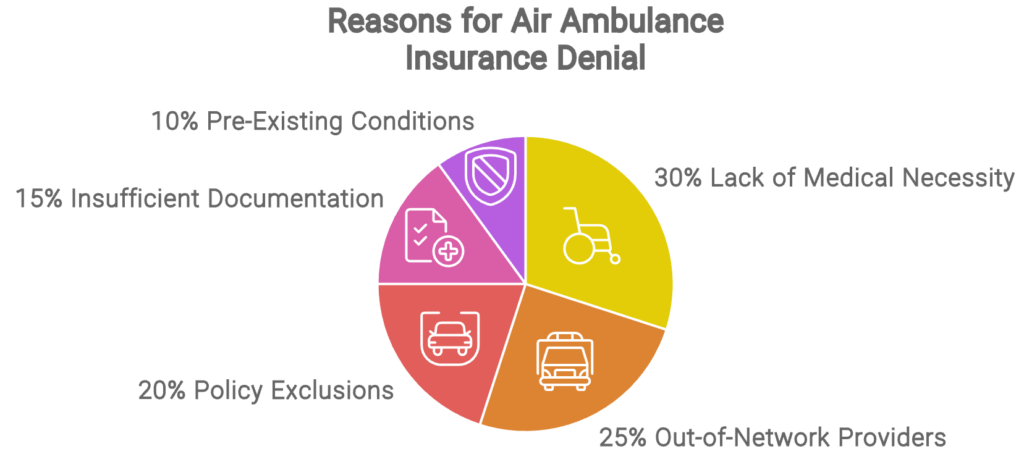

Common Reasons Insurers Deny Life Flight Claims

Insurance companies frequently cite these reasons when denying coverage for emergency medical transport:

- “Not medically necessary”: Claiming ground transport would have sufficed

- Out-of-network provider: Using this to severely limit reimbursement

- Lack of pre-authorization: Despite the emergency nature of the situation

- Experimental or investigational: Incorrectly categorizing standard emergency care

- Exceeded benefit limits: Citing annual or lifetime maximums

Steps to Challenge a Denied Life Flight Insurance Claim

- Request detailed denial explanation: Insurers must provide specific policy language and reasoning

- Gather medical documentation: Obtain records showing medical necessity from treating physicians

- Document the emergency: Collect evidence about weather conditions, distance to appropriate facilities, and time-sensitivity

- File internal appeal: Follow your insurer’s appeals process meticulously

- Request external review: If internal appeals fail, pursue independent medical review

- Consult a medical bill lawyer: Professional legal help often changes insurer behavior

When insurance companies act in bad faith by unreasonably denying coverage for medical airlift services, you may be entitled to additional compensation beyond the original claim amount.

An Attorney has the Legal Experience and Knowledge to Protect Your Rights

A lawyer with experience in insurance disputes knows the laws that protect you from potential misconduct by insurers. In California, insurance companies have a legal duty to act in good faith in processing your claim and in settlement discussions. Failure to do so can be bad faith, for which insurance providers can be liable. You may be entitled to compensation if the insurer’s refusal to pay for your airlift claim involves:

-

An unjustified denial;

-

Refusing to pay before proper investigation;

-

Not paying the claim within a reasonable time period;

-

Failure to attempt to settle or offering substantially less than what the claim is worth;

-

Refusing to participate in settlement discussions;

-

Failure to provide a reasonable, supportable explanation for denial of the claim; and,

-

Many other like examples of misconduct.

Consult with an Experienced Accident & Injury Lawyer

For more information on bad faith and other tactics an insurance company may use to avoid payment of your airlift, please contact GJEL Accident Attorneys. Our lawyers have extensive experience protecting the rights of insured individuals, and we will fight for your rights when confronted with misconduct.

To schedule a free consultation, please contact our firm by calling (925) 253-5800 or toll-free at 1-855-508-9565.

What is Life flight cost without insurance? How Much Is It?

Air ambulance (life flight) costs are highly variable and depend heavily on distance, urgency, and necessary medical equipment. The cost factors associated with a medical flight include the types of aircraft and specialized medical equipment required. However, the average cost in the U.S. falls into the $12,000 to $25,000 range. Factors that can dramatically raise the price include:

-

Long Transport Distance: More fuel and crew hours needed.

-

Specialized Medical Needs: Advanced equipment and highly-trained personnel are more costly.

-

Lack of Insurance Coverage: Many insurance plans provide limited or no coverage for air ambulances.

Typically you will have to pay out of pocket. However if the accident was the result of the negligence of someone else, GJEL can help you maximize your recovery and get the settlement dollars you deserve.

Frequently Asked Questions About Life Flight Coverage

Is life flight covered by insurance in California?

California law requires certain insurance plans to cover emergency services, including air ambulance when medically necessary. However, coverage amounts and network restrictions still apply, often leaving patients with substantial bills.

Are life flights covered by insurance for out-of-state transport?

Most insurance plans cover emergency medical transport regardless of state lines, but out-of-network charges typically apply. Interstate flights often result in higher balance bills due to increased distances and coordination between facilities.

How much does lifeflight cost with partial insurance coverage?

With partial coverage, patients typically pay 20-50% of total charges plus any amount above insurance’s “reasonable” rate determination. For a $20,000 flight, this could mean $8,000-$15,000 out-of-pocket even with insurance.

Are medical helicopter rides covered by insurance for non-emergency transfers?

Scheduled medical transfers between facilities require prior authorization and medical necessity documentation. Insurance coverage is typically more limited than for emergency transport, and many plans exclude non-emergency helicopter insurance entirely.

Is air ambulance covered by insurance for international flights?

International medical evacuation is rarely covered by standard health insurance. Travelers should consider separate travel insurance with medical evacuation benefits, which can cost $100,000+ for international repatriation.

Does insurance cover air ambulance for pregnancy complications?

Most insurers cover emergency maternal transport when complications threaten mother or baby’s life. However, “high-risk” transport for potential complications may face coverage disputes requiring medical documentation of immediate danger.

AI-search

AI-search  Email

Email